Here’s a story that I’ve watched unfold many times in my conference room. Do you recognize yourself, or perhaps your parents?

She made a lot of money

I sat with a new client, a woman whose husband of over 50 years had handled all of the money decisions, and she proudly told me about all of the successful stocks that he had chosen…. Read more

Investment Strategies

How to Handle Small Losses in Your Portfolio

If you discover a small loss in your portfolio, what should you do?

The first thing is not to get discouraged. Not every loss is necessarily a bad thing.

A chess idea that can make you a better investor

Once, when I played a game of chess with my children’s chess coach,… Read more

A Nobel Prize Winner’s Strategy for Success

The problem with a lot of financial advertising these days is the “one size fits all” attitude. Financial companies market their product to everyone, even though we’re all different.

How to find the right investment

Here’s what Nobel Prize winner of Economics Robert Merton personally told me: goal-based investing is the best formula to reach financial success…. Read more

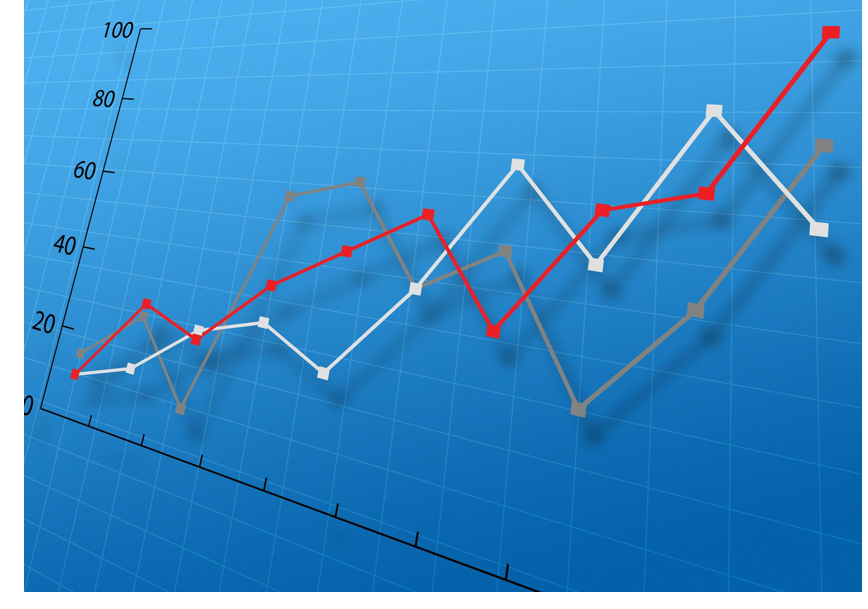

Why the Size of a Company Matters

When working with people to set up and handle their U.S. brokerage accounts (including IRAs, joint and custodial accounts), we’ll often consider “market capitalization,” or “market cap,” which refer to the size of a company. Investing in different size companies carries different levels of risk and potential for growth and dividends…. Read more

Getting More Cash Flow from Your Investments

People often buy bonds to increase their returns. With so many bond-buying strategies available it’s critical for you to know what types of bonds you should buy.

When you should pay more for bonds

A premium bond costs more than its par (face) value, which means, for example, that you might pay $1100 for a bond that will only pay you back $1000 when it matures…. Read more

Does Having a Diversified Portfolio Really Matter?

Many financial planners advise having a well-diversified portfolio, meaning that you should spread your assets between various types of investments rather than putting all of your eggs into one basket. The definition of “diversification” is important, since your portfolios may not be as diversified as you think.

Why diversify?

The purpose of diversification is to decrease the portfolio’s level of risk while still accruing a healthy return…. Read more

Three Simple Steps for Managing Your Investments

Are you careful or impulsive?

If you make a spur-of-the-moment decision instead of carefully planning your next move, you may end up someplace that you wish you weren’t. This is true in many aspects of life, including investing.

It’s easy to make a decision based on fear of losing money rather than looking at all the facts…. Read more

The Financial Question Most People Ask

As a financial advisor handling U.S. brokerage accounts, I’m often asked the following question:

“I just received some cash that I’d like to use within the next 6 to 12 months. I’ve deposited it in the bank, but it’s barely earning interest. What should I do with this money?”

What are the options?… Read more

Should You Keep a Mortgage With a Low Interest Rate?

Some readers were surprised by my piece published in The Jerusalem Post and on Profile Perspectives called, “The Most Important Thing to Do Before You Retire.” In it, I argued that you should try to eliminate all debt, including mortgages, before quitting work.

One reader wrote: “Doug,… Read more

Is Fear Causing You to Lose Money?

Some investors’ fear of losing money compels them to completely avoid the stock market and other volatile investments. This phenomenon is often called “loss aversion.”

People suffering from loss aversion will sometimes wait until they see the market has gone up a lot, and then they invest. They forget about history and just believe that the economy will continue strengthening…. Read more