After decades of working with American retirees living in Israel, I’ve found that the hardest financial lesson isn’t about investing or taxes. It’s knowing when you have enough. Too many people move the goalpost just when they’re about to reach it. When expectations continually change, what defines financial success?

The problem with keeping up

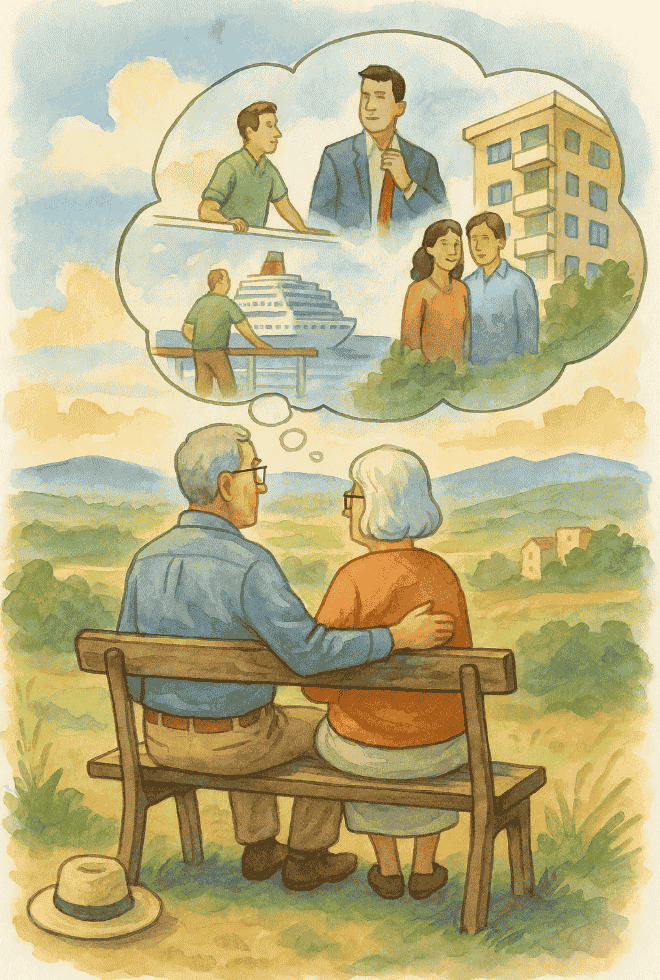

Picture a retired couple in Jerusalem with a stable U.S. pension and a well-managed IRA. They enjoy trips to the Kinneret, spoil their grandkids, and give charity. Life feels good, and they are happy until they scroll through social media and see friends buying apartments for their kids or cruising the Mediterranean. Suddenly, their contentment turns into financial anxiety.

Don’t let social comparison drive your financial decisions. A minor-league baseball player making $500,000 might feel poor compared to Mike Trout’s $36 million salary. Even Trout could feel small next to a hedge fund manager making hundreds of millions. The problem isn’t what you have. It’s how much more you think you need to feel secure.

“Enough” is freedom

When you decide “this is enough,” you are in the driver’s seat. Your choices—not the market—set the direction. Anyone who has overdone it at an all-you-can-eat buffet knows that more isn’t always better. Yet with money, many people keep piling on risk and complexity long after reaching financial independence.

The cost? Stress, poor investment choices, and sometimes losing sight of the values that matter most.

Avoiding unnecessary risk

Retired Americans in Israel often ask if they should take on more risk to “keep up” with peers or other benchmarks. But once your core needs and goals are covered, chasing an extra percent of return can do more harm than good. The real goal isn’t to die with the largest portfolio. It’s to build a portfolio that lets you live your goals and values, and, in good times and bad, that lets you sleep well at night.

If you’re wondering whether your plan reflects what truly matters or if pressure to “keep up” has influenced your choices, schedule a free Cross-Border Financial Evaluation by clicking here.

Douglas Goldstein, CFP® is the director of Profile Investment Services, Ltd. www.Profile-Financial.com. He is a licensed financial professional both in the U.S. and Israel. Call (02) 624-2788 for a consultation on how to set up your American assets to meet your financial goals. Securities offered through Portfolio Resources Group, Inc. Member FINRA, SIPC, MSRB, FSI. The opinions expressed are those of the author and not those of Portfolio Resources Group, Inc. or its affiliates. Neither PRG nor its affiliates provide tax or legal advice.

Published August 27, 2025.