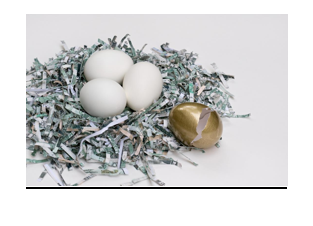

Many financial planners advise having a well-diversified portfolio, meaning that you should spread your assets between various types of investments rather than putting all of your eggs into one basket. The definition of “diversification” is important, since your portfolios may not be as diversified as you think.

Why diversify?

The purpose of diversification is to decrease the portfolio’s level of risk while still accruing a healthy return. The theory is that while one asset class increases, other ones decrease. Traditionally, for example, people say that when bonds become less popular, stocks prices rise (though it’s not always true).

Diversification is important among different asset classes (stocks, bonds, real estate, cash), as well as within a particular asset class (large cap stocks, mid- and small cap stocks, foreign equities, different types of companies, etc.) The fear of owning too many mutual funds or ETFs (Exchange Traded Funds), is that each fund invests in the same underlying investments, and while you think you may be diversified, you really aren’t.

Due to the effects of the 2008 “credit crunch,” alternative investments and strategies are now commonly used as diversifiers. Many consider fixed income a good diversifier when offset by “real assets,” such as REITs, which can protect against the ravages of inflation. Treasury bonds are still considered to be one of the most effective diversifiers against equities. However, all investments have their pros and cons.

Is your portfolio diversified?

Interestingly, if you’re always not happy with one part of your portfolio, this can actually be a good sign because your portfolio is not always steered towards a single economic outcome. In this case, regardless of a bull or bear market, some investments will always balance out the others. Therefore, if one of your investments is dragging behind, it may be a sign of a truly diversified portfolio.

It’s always important to review your asset allocation/diversification of your portfolio. The correct balance of investments and risk can make all the difference to your financial success.

For more about portfolio diversification, go to Profile-Financial.com/diversification

Douglas Goldstein, CFP®, is the Director of Profile Investment Service, Ltd., which specializes in helping people who live in Israel with their US dollar assets and American investment and retirement accounts. He helps olim meet their financial goals through asset allocation, financial planning, and using money managers.

Published June 8, 2015. Updated September 2019, July 2022