In a well-diversified portfolio, you normally have three different type of earnings — appreciation, dividends or interest. “Appreciation” is the growth in the value of your investment based on the market going up. Income investors receive “dividends” or “interest” on their investments.

Interest

Interest is what you earn on money you lend out. … Read more

Investment Strategies

Corporate or Treasury Bonds-Which Bonds are Better?

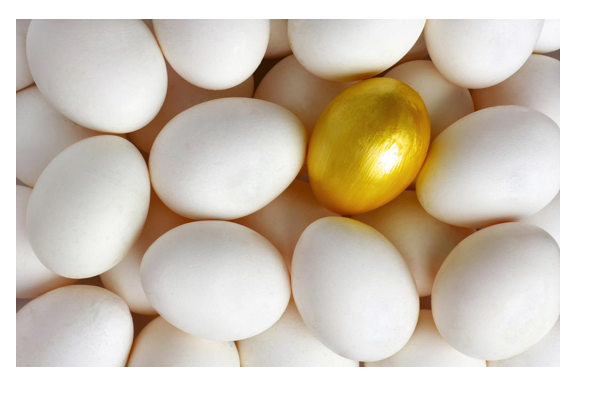

Corporate and Treasury bonds can help you turn your nest egg into an income stream. In fact, generating a steady income stream to supplement your pension may be one of the hardest parts of retirement.

Bonds have a set interest rate and they usually pay twice a year so you know exactly how much income you should receive and when you can expect to receive it…. Read more

What is the Best Way to Reduce Risk in Your Portfolio

Wouldn’t it be great if there was a fail-proof way to reduce risk in your retirement portfolio?

Any investment ad worth its weight in gold has a disclaimer, “All investments are subject to risk.” That is because risk is the operative term when it comes to investing. In theory,… Read more

Does Investor Bias Make You Underperform the Market?

A friend recently had a losing streak at the casino. Instead of walking away, he played more hands of blackjack. “I was determined to win,” he lamented. In fact, he was playing to recoup his losses.

He was a victim of investment biases subconsciously affecting his decision-making. Gambler’s Fallacy – the belief that after a streak of losses his luck would turn – duped him into doubling his losses…. Read more

Should You Follow Investment Trends or Bet against the Masses?

Today, many “investment trend” websites are enticing online traders to join. Investors who follow the trend – also known as “momentum trading” – invest in stocks based on rising market prices rather than company fundamentals.

The strategy of following the investment trend performs best in a bull market. However, selling before the trend reverses is a skill that eludes most investors…. Read more

Do You Look at the Risk-Reward Ratio of Your Stocks and Bonds?

The risk-reward ratio is an attempt to quantify the amount of risk you need to take in order to get an anticipated return from any investment.

If you were to only consider past returns when deciding whether to invest in stocks or bonds, stocks would appear to be the clear winner…. Read more

How to Safely Boost Returns in a Low Interest Rate Environment

To the dismay of yield-seeking investors, interest rates remain at historic lows. Although rates on long-term bonds may begin to inch up, analysts generally expect that we may remain in a low-interest-rate environment for a while longer. So, what are income investors to do? It is important to understand the risks of reaching for higher yields and realize there may be less risky ways to increase income…. Read more

How to Prepare for the Next Stock Market Crash

Over the past several years, the market has climbed to historic highs, prompting analysts to sound the alarm over the next stock market crash. While I can’t say when the next crash will occur, I can say it’s reasonable to assume that there will be another stock market drop at some point…. Read more

How to Make a Good Investment Decision

Since one person’s good investment choice may be a huge mistake for someone else, what factors should you consider when deciding upon a potential investment?

In investing, the only hard and fast rule is that past performance never guarantees future returns. Though you should try to understand why a security acted in a specific way in the past,… Read more

What You Need to Know About Asset Allocation

Was Miguel Cervantes’ Don Quixote fighting imaginary windmills or market volatility when he said, “Don’t put all of your eggs in one basket?” Putting all of your assets in one basket doesn’t keep them as safe as you might think because there is always a risk that you might lose them all at once…. Read more