Recently, I found myself in the Financial Professional’s Twilight Zone when a client assured me, “It’s OK if I lose money. My investments are for the long term and the market always goes back up eventually.” Why was this client so carefree?

Some investors think that if they lose money on an investment,… Read more

Investment Strategies

Should You Engage in Copycat Trading?

“Copycat trading” is when a regular trader copies the trades of more experienced and successful traders. It sounds simple enough: copying someone else’s trades makes trading easier for you as it eliminates the need for you to do your own research. If you want to trade foreign exchange, for example, just follow the top performing foreign exchange trader;… Read more

Gambling vs. Investing: Where Are You More Likely to Win?

Can you make more money gambling in a casino or investing in the stock market?

Both investors and gamblers make decisions on where to place their money based on the likelihood of certain events happening. The probability of high gambling returns is low. In fact, the slot machine is the ultimate game of chance as its returns are random…. Read more

The Critical Questions Successful Investors Ask Their Financial Advisor

When potential clients come in for an introductory meeting, I find that they frequently ask me the wrong questions. While my background and my firm’s corporate culture (“servicing our clients” is our priority) are important topics, details like specific investments and historical rates of return shouldn’t be the focus of the initial meeting…. Read more

3 Things to Know to Sound Smart When Buying Bonds

“Are bonds safe?” asked a fellow in a café who recognized me from the Friday paper. He then looked down and lamented having to pay NIS 22 instead of NIS 14 for his coffee. “Inflation,” I commented. Then he asked for advice about bonds: “If the central bank raises interest rates to control inflation (rising prices),… Read more

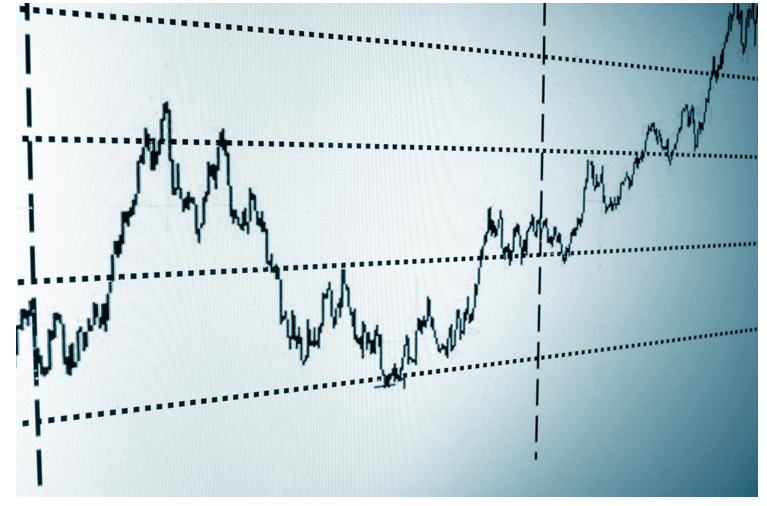

Do Market Timers Generate High Returns?

Can market timers outperform the market?

One of the most watched bets in investment history just wound down. Ten years ago, billionaire stock investor Warren Buffett wagered that the S&P 500 Index would outperform five hedge funds over the next decade. The bet was a classic “passive investing” vs. “active investing” showdown…. Read more

Why a Stock’s Price Doesn’t Matter

There are many factors to consider before buying a stock, but the sticker price shouldn’t be one of them.

This joke illustrates why:

A market analyst walks into a pizzeria and orders a pizza. When the pie is ready, he’s asked, “Should I cut it into eight or 16 pieces?”

The analyst replies,… Read more

Growth vs. Income Investing: Is the Cost of Growth Too High?

According to conventional “growth vs. income” investing advice, if you are a young, upwardly mobile millennial you should put more money in growth stocks that have more risk, but higher potential than other investments. If you’re closer to retirement, you should choose a more conservative investing strategy. Yet even retirees need some growth to counterbalance inflation,… Read more

Should Retirees Diversify Globally to Protect Their Savings?

Retirees who diversify globally protect themselves from investing with too much home bias.

If you are saving for a future retirement, your goal is probably to grow your capital. If you only focus on higher returns, though, you may take risks you cannot afford. Markets are volatile. Diversifying globally may be a good way to lower volatility and smooth out returns…. Read more

Should I Sell Out before Losing Money in a Stock Market Crash?

A retiree called me, nervous about the stock market crashing. He wanted to know if he should abandon the markets by selling his stocks and staying in cash.

An alternative to timing the market

Since you can’t predict when the market will crash, you need a good defense. Historically,… Read more