“I’m making aliya next month, Doug,” a soon-to-be-retired doctor called from New York to tell me. “Now that I’ll be living in Jerusalem, should I move my investments to Israel and transfer all my brokerage and bank accounts to one of the Israeli banks?”

Look at each part individually

Moving yourself and your family to Israel,… Read more

Investment Strategies

What American Expats Need to Know About Foreign Mutual Funds

If you’re an oleh from the United States and you’re considering putting your money into an Israeli or other foreign mutual fund, think again.

Here’s why:

Owning a foreign mutual fund may cause increased U.S. taxes

If you have money in a teudat sal,… Read more

Is it Hard Not to Worry About Your Stocks?

Are you finding it hard not to worry about your stocks? Even experienced investors tremble when the market goes crazy. Here’s what you can do now to minimize your worries:

Ignore the news.

Avoid the “hot” tips that you hear from friends or read about on the internet…. Read more

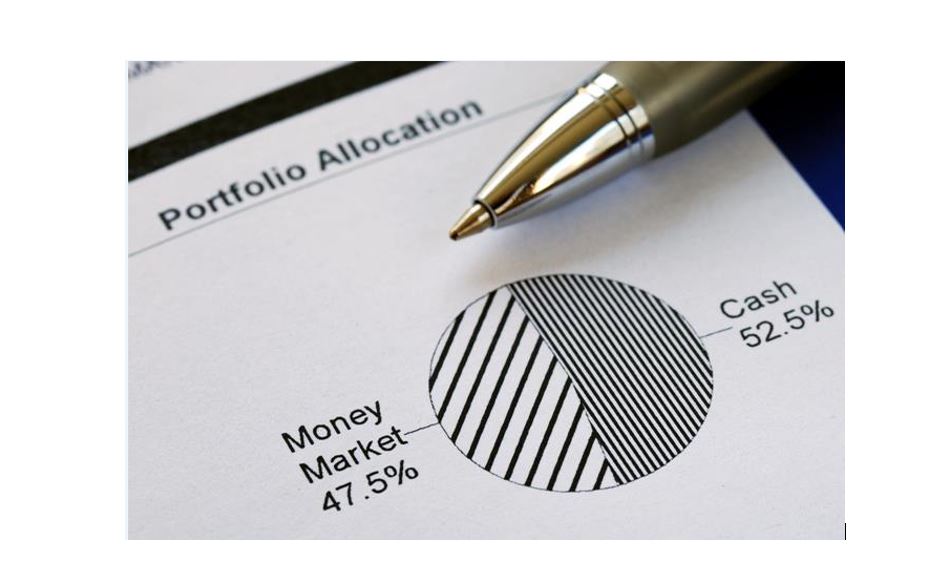

Can Mutual Funds or ETFs Improve Your Portfolio’s Performance?

Myth: Americans living in Israel can’t buy mutual funds.

Fact: Americans in Israel can buy mutual funds, but read carefully….

On last week’s The Goldstein On Gelt Show, I offered a free download of a 7-step list for investing in mutual funds…. Read more

Here’s a Quick Way to Invest in the Stock Market

Here’s a story that’s supposed to illustrate a quick way to invest in the stock market and make a lot of money:

They say that legendary investor Peter Lynch, who ran one of the biggest mutual funds of all time, discovered L’eggs, not from his market research, but rather from his wife…. Read more

The Investment Tool You Need to Invest Your Money Like the Pros

“What investment tool I can use to make money like the rich people do?” a new client asked me. I could see he wasn’t looking for an in-depth financial education about how to identify great stocks. He just wanted a simple system he could easily follow to increase his chances of making money. … Read more

How to Make Money in an IRA

When you withdraw money from your IRA (or if you inherited an Individual Retirement Account from someone and take yearly distributions), don’t fool yourself.

Just because you withdraw money from a retirement account does not mean that you actually made that money. Rather, you might just be pulling out your principal. … Read more

How Much Money Can You Afford to Lose in a Risky Investment?

If I asked you, “How much money do you want to lose in a risky investment?” you would probably think this was a strange question. However, you must consider the risks before you invest.

When you put money in the stock market you give up the certainty in return for the potential reward of growth…. Read more

Do Simple Investments Generate Higher Returns?

Simple investments can help increase your returns.

When Confucius said, “Life is really simple, but we insist on making it complicated,” he could have been alluding to the fact that using complicated investing strategies can reduce your overall performance. Simple investment strategies (like diversification and dollar-cost averaging) may have the best chance to lead to long-term success…. Read more

Why Getting an Inheritance Doesn’t Always Make You Rich

“If you spend that amount of money from the inheritance you just received,” I told a client a few years ago, “it’s going to vanish over time.” Guess what? It did. This client spent hundreds of thousands of dollars and had nothing to show for it, other than feelings of regret…. Read more