Doug is licensed in Israel and in the United States to help clients make prudent financial decisions with their money. Here’s an explanation of what the different licenses mean:

American Licenses

Series 7: Doug has had this license since 1992. It enables him to sell all types of securities, except commodities and futures. This license is administered by the Financial Industry Regulatory Authority (FINRA). Stockbrokers in the United States need to pass the Series 7 exam to obtain a license to trade. The Series 7 exam focuses on investment risk, taxation, equity, debt instruments, packaged securities, options, retirement plans, and interactions with clients.

Series 8: In 1997, Doug passed this exam, also known as the “General Securities Sales Supervisor Examination,” which enables him to oversee other financial professionals.

Series 63 and Series 65: Doug took these exams (in 1992 and 2005 respectively) known as “Uniform Investment Adviser Law Examination” and “Uniform Securities Agent State Law Examination.” The 63 license qualifies individuals to provide investing and general financial advice to clients. Passing the Series 65 exam qualifies individuals as “Investment Advisor Representatives” (IARs). These are the topics covered in the exam:

- Economic factors and business information

- Investment vehicle characteristics

- Client investment recommendations and strategies

- Laws, regulations, and guidelines on ethical business practices

Series 31: Doug has had this license since 1993, which enables him to sell managed futures funds or supervise those activities.

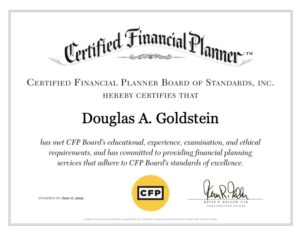

CFP® (Certified Financial Planner™ professional): Doug received his CFP® designation in 2005. To be allowed to sit for the exam, the CFP board requires candidates to complete coursework in the following topics:

CFP® (Certified Financial Planner™ professional): Doug received his CFP® designation in 2005. To be allowed to sit for the exam, the CFP board requires candidates to complete coursework in the following topics:

- General principles of finance and financial planning

- Retirement planning

- Estate planning

- Financial planning and consulting

- Investment and Securities Planning

- Asset protection planning

- Insurance planning

- Employee Benefits Planning

- State and federal income tax planning

- Estate tax, gift tax, and transfer tax planning

GFP® (Global Financial Planning Professional):

Recipients of this designation have passed the ‘Master Class in US Inbound/Outbound International Financial Planning’ OR an equivalent exam AND fulfill the following requirements: CFP®, ChFC, CPA/PFS, CFA, CIMA, or CPWA accreditation.

A Global Financial Planner:

- A GFP-certified advisor has a high level of expertise in global financial planning. This certification reflects athorough understanding of various financial instruments, investment strategies, and the ability to navigate complex international financial landscapes, ensuring clients receive knowledgeable and well-informed advice.

- Adherence to Global Standards: GFP certification signifies that the advisor adheres to internationally recognized standards and practices. This commitment ensures that clients receive consistent and reliable services that are in line with the best practices established worldwide.

- Tailored Solutions for Expats, Olim, and Others with Global Needs: GFPs provide tailored financial planning solutions that consider cross-border tax implications, international investments, and currency fluctuations, making them ideal for managing complex global financial portfolios. Note, a GFP is not a tax advisor and does not provide tax advice, but raises the questions that your tax professional include in your tax-planning.

Israeli License

Investment marketer: Since Doug lives in Israel and works with Israelis, even though he does not transact business on the Israeli markets, he is required to have an Israeli license. The investment marketer license as described in the Israeli law, allows him to provide, “investment marketing” which is, “…advice rendered to others regarding the feasibility of the investment, holding, purchase or sale of securities or of financial assets by an advisor that is affiliated with a financial asset….”

In 1997, the Israeli Securities Authority started requiring anyone who provided financial services in Israel to obtain a license and Doug was one of the first people to pass the licensing exams.

Permit according to Section 49A of the Securities Law:

ד. גולדשטיין – פרופייל אינווסמט סרוויסיס בע”מ (להלן: “החברה”) הינה בעלת היתר הרשות לפי סעיף 49 א לחוק ניירות ערך (להלן: “ההיתר”).

ההיתר ניתן בהסתמך על הצהרת החברה כי היא נתונה לפיקוח של הבורסה לניירות ערך בתל אביב. פעילות החברה אינה מפוקחת על-ידי רשות ניירות ערך.

אין בהיתר משום הבעת דעה על טיבו של השירות הניתן בידי בעל ההיתר או על הסיכונים הכרוכים בו.

D.Goldstein- Profile Investment Services Ltd. [hereinafter: “the company’] is the holder of the Authority’s permit according to Section 49a of the Securities Law [hereinafter: “the permit”]. This permit was granted based on the company’s statement that it is subject to the supervision of the Tel Aviv Stock Exchange. The company’s activity is not supervised by the Securities Authority. The permit does not express an opinion on the nature of the service provided by the permit holder on the risks involved.